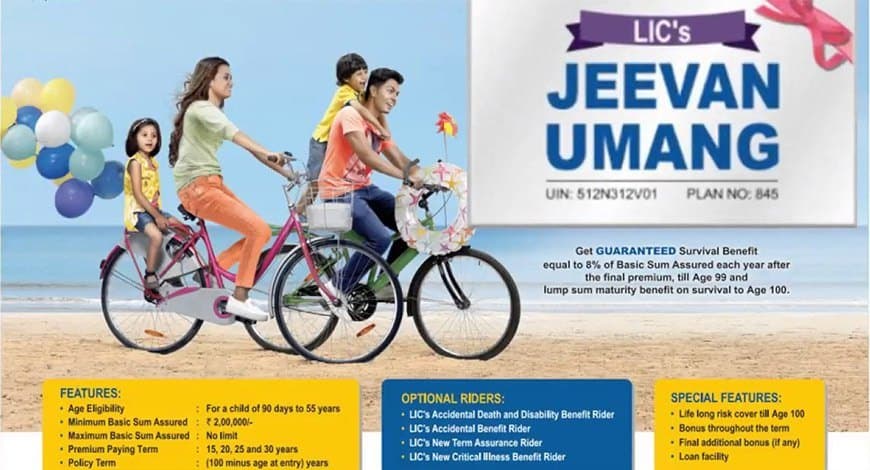

LIC's Jeevan Umang (Plan No. 845)

A Whole Life Assurance plan that is Non-Linked and Participating (With Profits). It provides a combination of income and protection, offering annual survival benefits from the end of the premium paying term until maturity at age 100.

About This Policy

LIC Jeevan Umang is a premium plan designed to provide financial security and a regular stream of income (Survival Benefit) for life after the premium payment term ends. It combines the safety of guaranteed annual payout (8% of BSA) with the potential for growth through participation in profits (bonuses) while keeping the life cover active until the insured reaches 100 years of age.

Key Features

Policy Benefits

Death Benefit

Sum Assured on Death + Vested Simple Reversionary Bonuses + Final Additional Bonus (if any). 'Sum Assured on Death' is the Higher of: 1. Basic Sum Assured 2. 7 times the Annualized Premium (The benefit is guaranteed to be at least 105% of all premiums paid up to date of death.)

Maturity Benefit

Basic Sum Assured + Vested Simple Reversionary Bonuses + Final Additional Bonus (if any), payable at age 100.

Survival Benefit

8% of Basic Sum Assured paid annually, starting from the end of the Premium Paying Term until maturity or earlier death.

Tax Benefits

Premiums qualify for deduction under Sec 80C. Maturity and Survival Benefits are tax-exempt under Sec 10(10D).